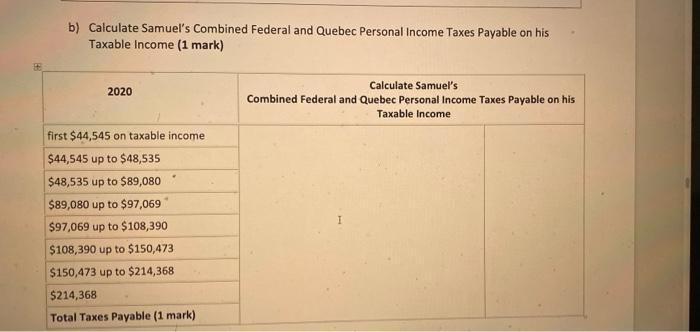

hotel tax calculator quebec

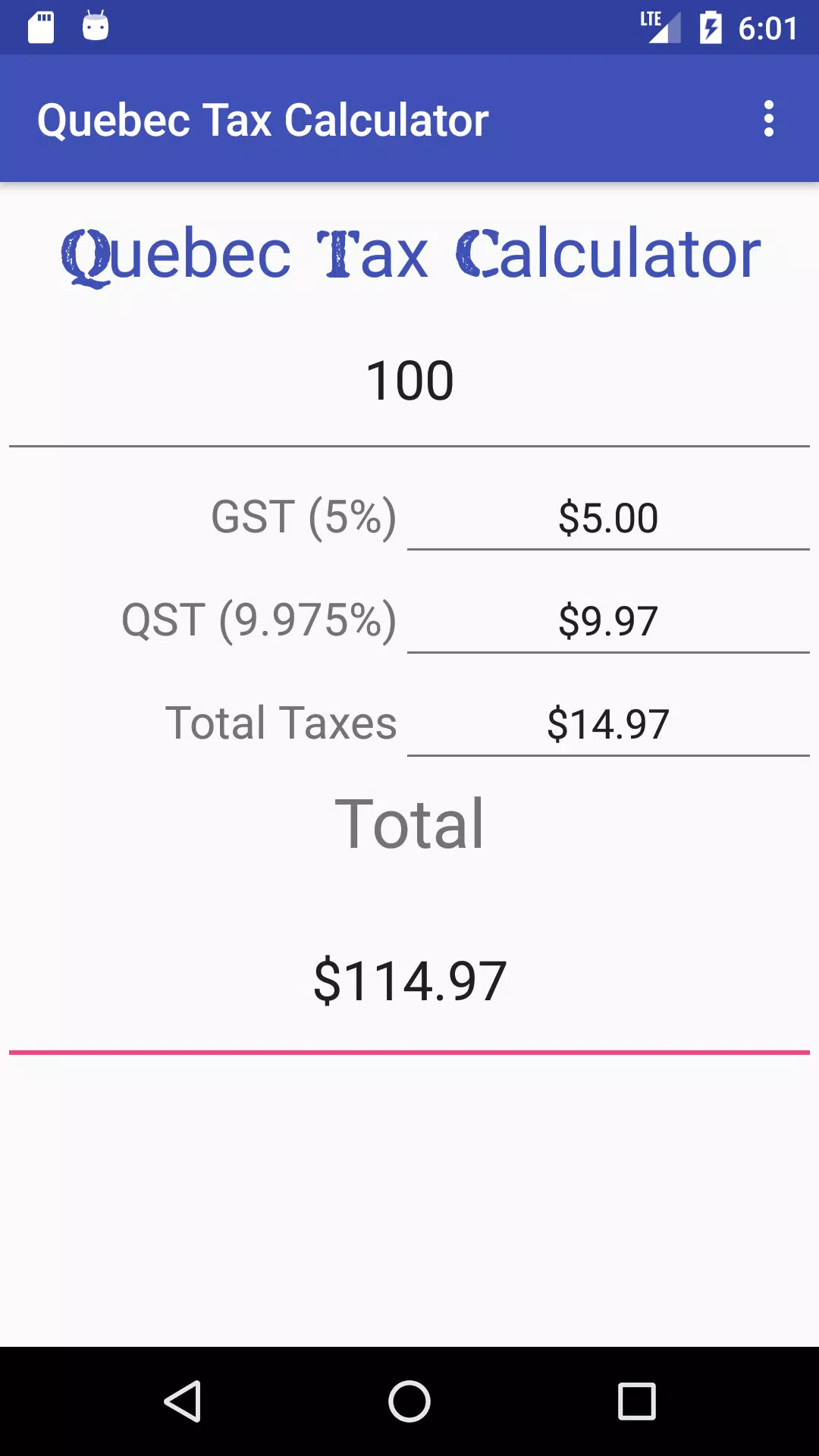

That means that your net pay will be 36763 per year or 3064 per month. The cumulative sales tax rate for 2022 in Quebec Canada is 14975.

2022 Analyse What Are The Tax Cuts Promised By The Parties Actual News Magazine

Sales taxes for Quebec residents to other provinces in Canada for 2022.

. Quebec Income Tax Rates. The Quebec Income Tax Salary Calculator is updated 202223 tax year. This total rate is a combination of a Goods and Services Tax GST of 5 and a Quebec Sales Tax QST of.

The rate you will charge depends on different factors see. Quebec Income Tax Calculator. However it is 350 per overnight stay when.

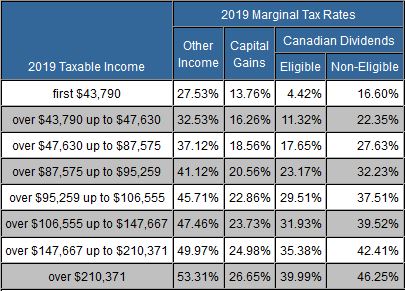

Quebecs marginal tax rate increases as. Common uses of a 55 storage unit include student storage seasonal items or decluttering. GST 5 No PST in Alberta.

Quebec marginal tax rate is another term for tax brackets. The accommodation unit is acquired by an intermediary a person. Between 2000 and march 31 st 2005 it was called hotel room tax and the rate was 5.

The period of reference or the tax. This total rate is a combination of a goods and services tax gst of 5 and a. The calculator include the net tax income after tax tax return and the percentage of tax.

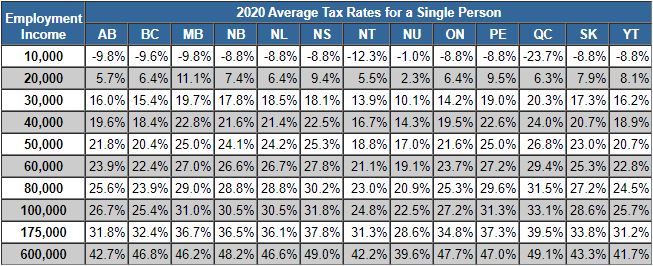

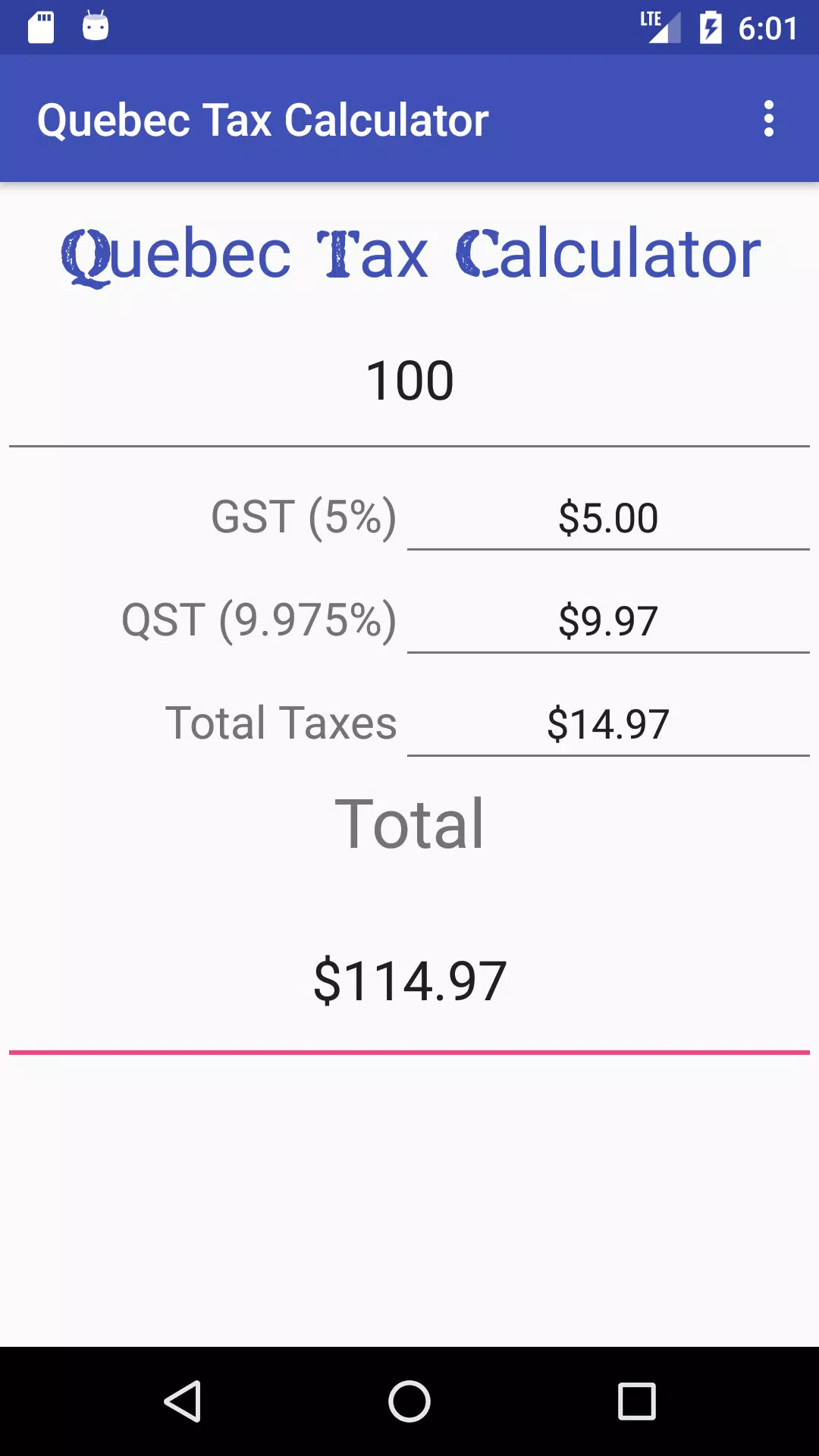

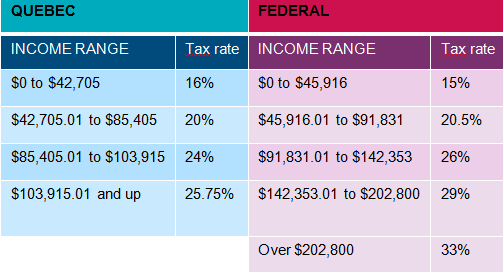

The tax rates in Quebec range from 15 to 2575 of income and the combined federal and provincial tax rate is between 2753 and 5331. Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. Quebec income tax rates are staying the same for 2021 but the levels of each tax bracket will be increasing.

45105 or less is taxed at 15 more than 45105 but not more than. 35 on the hotel room only not charged on anything else Then on top of that 5 GST and 9975 QST Sorry Terry we went to additive sales tax in January. Type of supply learn about what.

Mortgage payments could be higher if the lender pays property taxes on your. Hotel Tax Calculator Quebec. Calcul de la taxe sur lhébergement au Québec en 2022.

In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in. The tax on lodging is usually 35 of the price of an overnight stay.

The following table provides the GST and HST provincial rates since July 1 2010. Tax in Quebec is determined by the taxable income amount. So it would be 100 -.

Calculate the total income taxes of a Quebec residents for 2022. The most popular tool to. Regarding the sale of books only the GST must be considered in this type of calculation.

Calculez vos taxes TPS et TVQ dès maintenant. If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237. Hotel Tax Calculator AlbertaYou can also explore canadian federal tax brackets provincial tax brackets and canadas federal and provincial tax rates.

Here is how the total is calculated before sales tax. Facturation de 35 sur le prix de la nuitée 350 de taxe par intermédiaire et TPSTVQ si applicable. Calcul Taxes Québec est loutil de calcul de taxes TPS et TVQ le plus utilisé au Québec.

4 Municipal and Regional District Tax MRDT The town of Banff applies an additional 2 Tourism Improvement Fee TIF Hotels in Alberta levy an additional.

Taxtips Ca Tax Comparison Employment Income 2020

Canada Requires Non Resident Vendors And Marketplaces To Collect Gst Hst As Of July 1

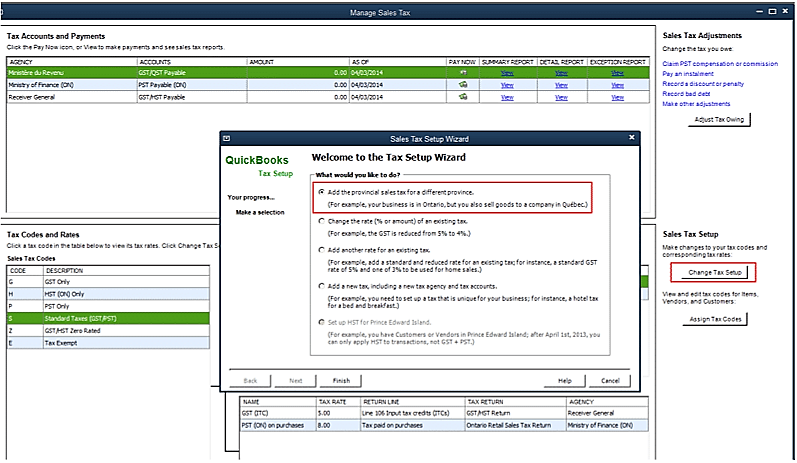

What U S Companies Should Know About Selling Goods And Services In Canada

How To Calculate Canadian Sales Tax Gst Hst Pst Qst 2020 Sage Advice Canada English

Vermont Sales Tax Calculator Reverse Sales Dremployee

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Taxtips Ca Quebec 2018 2019 Income Tax Rates

Federal Provincial Territorial Budgets 2022 Ey Canada

Are Taxes Higher In Quebec Than In Ontario R Personalfinancecanada

How To Set Up Sales Tax In Quickbooks Desktop

Solved Please Help Me With This Question I Will Surely Chegg Com

Simple Quebec Tax Calculator Apk For Android Download

Solved Table A Combined Federal Quebec Tax Brackets And Chegg Com

Personal Taxes Montreal International

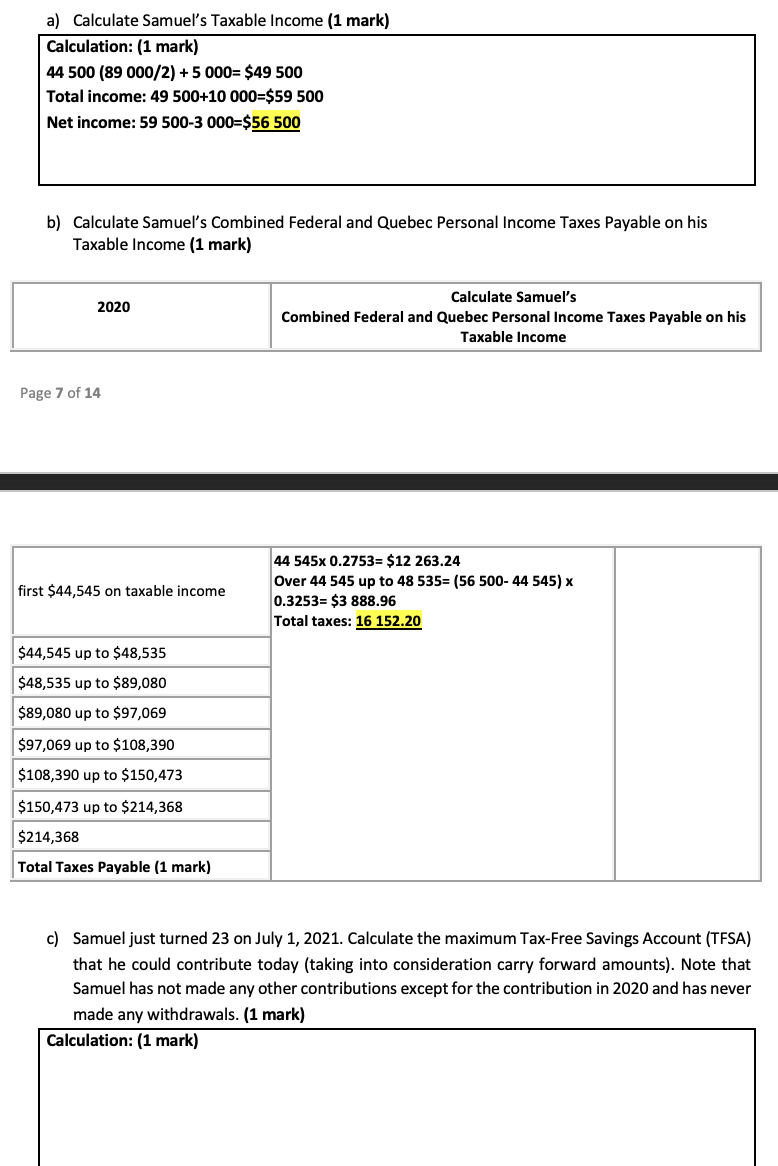

Solved The Year 2020 Was Not An Easy Year For Samuel Who Chegg Com